Union City Storm Damage Cleanup & Claims Guide

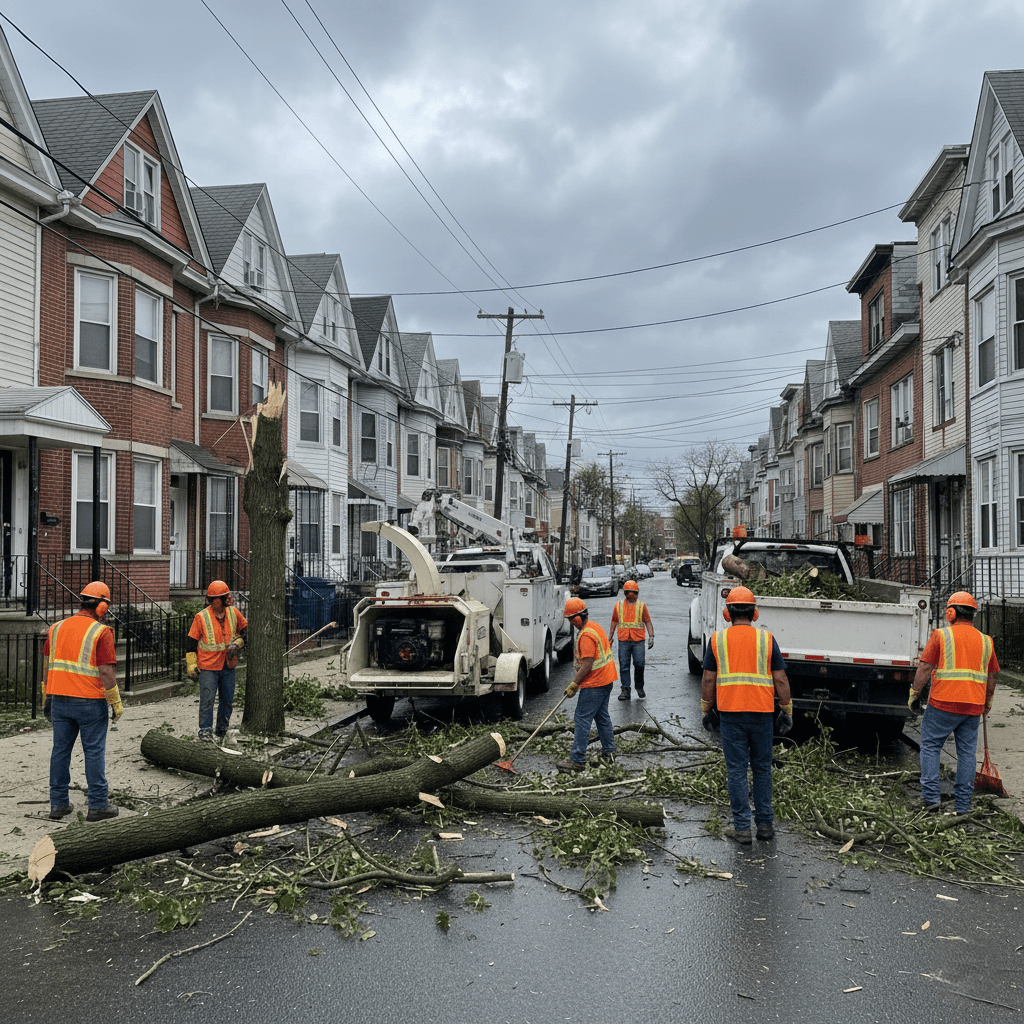

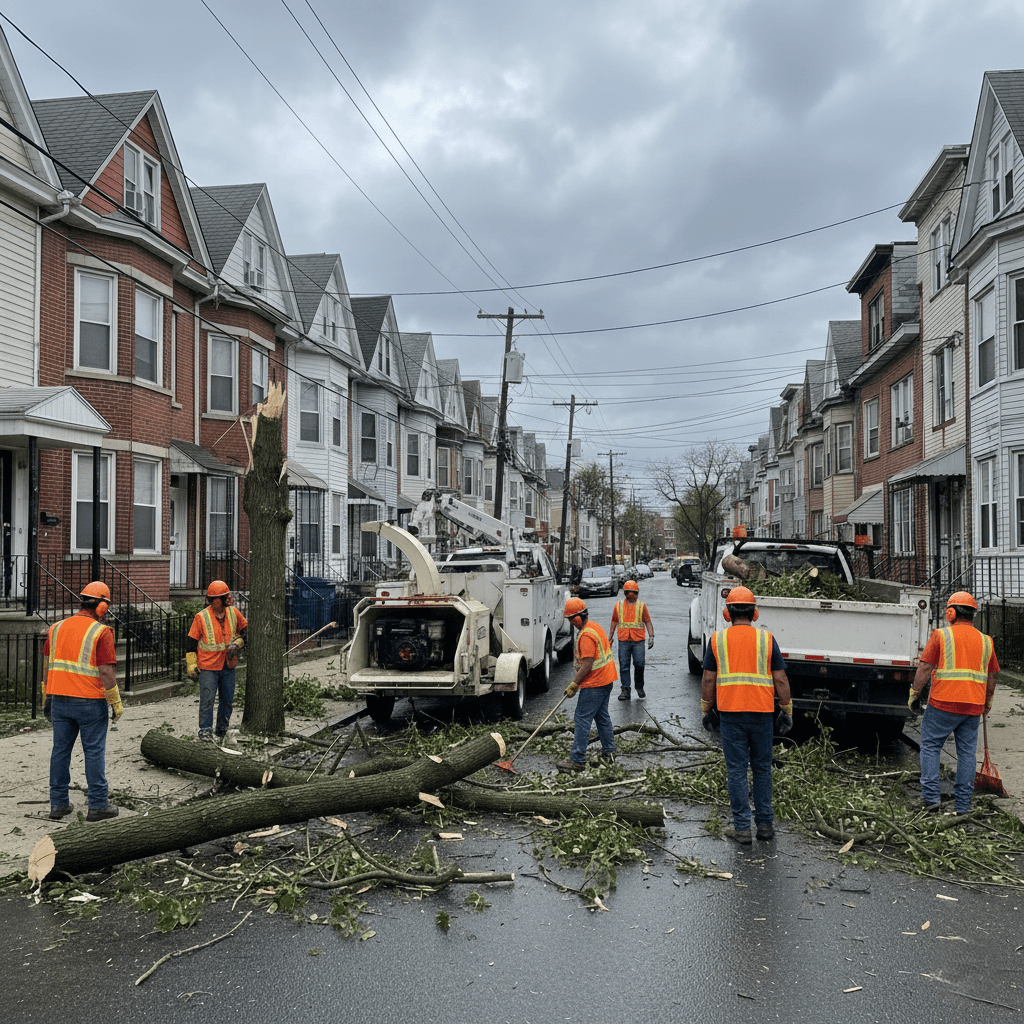

Storm Damage Cleanup Union City

Severe storms are impacting Union City with increasing frequency and causing property owners significant problems in relation to damaged or destroyed trees, structural damages, and complex claims against their insurance companies. Proper procedures for responding to severe weather events will protect your safety, property and financial well-being during a very stressful time. The purpose of this full service guide is to assist you with the immediate action steps necessary to take when a disaster has occurred and to provide you with the documentation requirements and the insurance process necessary to maximize your claim recovery and complete an efficient storm damage cleanup.

Immediate Safety Response

First and foremost, after any type of storm, your primary focus is to make sure all individuals on your property are safe. Avoid approaching any fallen trees or branches that contact power lines (stay at least 30 ft away), and contact your local utility company right away to report any downed lines – and always assume any line still down is live until an electric company representative says it’s safe.

Before going into any structure that has had trees fall on it, evaluate any structural damage from a safe distance. A damaged roof, wall, or foundation compromises the structure and is best evaluated by a professional. If trees block either the entrance or exit to your property, local emergency responders will be able to help gain safe access, while you make arrangements for a professional to remove the trees.

Emergency Tree Removal Contacts

If fallen trees pose a threat to life or property, contact emergency tree removal services ASAP. Emergency crews can be dispatched 24/7 to stabilize the dangerous situation and minimize further damage. Emergency services don’t need your insurance approval; homeowners are expected to take immediate action to mitigate additional damage.

Hudson County Storms

Union City is located in Hudson County, where numerous severe weather-related events occur during the course of the year. Windstorms with damaging winds happen frequently during the summer months, and winter storms with heavy snow-load stresses tree limbs. The National Weather Service consistently issues Severe Weather Watches for our area, particularly for flash-flooding and wind events.

Areas in Union City, which are elevated and adjacent to the Hudson Palisades, are exposed to much stronger winds during storms. These areas subject trees to more stress, and thus have a higher risk of failing. Urban areas in Union City with high population density and poor drainage areas have a higher risk of flash-flooding, which can destabilize the roots of trees and lead to unexpected collapse.

Documentation for Claims

Thorough documentation is the key to submitting successful insurance claims. Start documenting the damages as soon as you’ve ensured your own safety. Take photos and videos of all the damage, and include multiple views of the fallen trees, structural damage, etc. In addition, include reference points to give an idea of the size of the trees and the extent of the damage to the surrounding area.

Keep documentation of the property conditions before cleaning up, as the insurance adjuster needs to document the extent of the damage and the cause. Document the condition of any identification markers, such as house numbers, property boundaries, and distinctive characteristics. Time-stamp all documentation if possible, and write down a description of what each photo/video represents.

Inventories of Damaged Property

Create a detailed inventory of all damaged property beyond the obvious structural damage. Record any damaged landscaping, patio furniture, fences, etc., that were damaged by falling trees or wind-blown rain. Collect receipts to document the value of any damaged property when possible, and list the approximate age and condition of any damaged property.

Insurance Coverage Basics

Homeowners insurance typically covers the cost to clean up debris after storm damage causes damage to an insured structure (such as a house, garage, or shed), as well as the cost of repairing the structure. Homeowners insurance does not typically cover the cost to remove trees that have fallen, unless those trees have damaged insured structures or fences or vehicles, or blocked access to your driveway or sidewalk.

Typically, homeowners’ insurance caps the amount it pays for tree removal, usually between $500 and $1000 per tree, but can vary based on carrier and policy language. The cap refers to the cost of removing debris from your property after the tree has been removed from any damaged structures. Debris removal from structures is usually covered under a different limit based on the Dwelling or Other Structures portion of your policy.

Common Denial of Claims Reasons

Insurers will normally deny claims for trees that fell due to the natural decay of the tree (age), rot, or disease, rather than the result of a covered storm event. Insurers anticipate homeowners to maintain their trees responsibly and remove any hazardous trees before they cause damage to themselves or others. Additionally, flood and earthquake damage rrequireseparate, specialized policies, in addition to standard homeowners policies.

File a Claim

Contact your insurance company as quickly as possible after a storm event occurs, preferably within 24 hours. Most insurance carriers have a claims hotline that operates 24/7 during severe weather events. When reporting your damage to the claims representative, report all damage initially reported, even if you haven’t completed assessing all damage yet. This sets the date for your claim.

Ask for clarification on the coverage limits, deductibles, and documentation requirements for your claim. Also, ask about temporary repair coverage, and if your policy provides Additional Living Expense coverage if your home becomes uninhabitable due to the storm.

Adjuster Meetings

After receiving notice of a meeting with an insurance adjuster, accompany the adjuster to your property when they inspect the damage to your property. Point out any damage you see to the adjuster, and be prepared to answer questions about the incident. Provide the adjuster with a comprehensive documentation package, including photos, videos, and written accounts of the damage and the circumstances leading to the damage.

Temporary Repairs and Mitigation

Policyholders have a responsibility to mitigate further damage after a covered loss. As such, homeowners are expected to perform reasonable temporary repairs to prevent additional damage to their property. Temporary repairs may include tarping a damaged roof, boarding broken windows, etc. Document all temporary repairs with photos, and save receipts for materials and labor used.

Do Not Perform Permanent Repairs

Until the insurance adjuster completes their inspection and approves the work, do not perform any permanent repairs to your property. Performing permanent repairs could invalidate your coverage for the original damage, since the insurance adjuster would be unable to verify the extent of the damage to your property.

However, emergency stabilization work necessary to protect the health and safety of occupants of the property should be performed immediately, regardless of whether or not a claim has been filed.

Certified Storm Damage Cleanup Contractors

There are many qualified tree service contractors in the area that can assist in the cleanup efforts associated with a storm. Qualified contractors have the specialized equipment and training to safely remove trees from structures without causing additional damage to the structures. Contractors have knowledge of how to properly stabilize unstable trees and manage complex tree removal situations.

Contractors who specialize in storm damage cleanup are knowledgeable about the insurance process and can help facilitate the claims process for their customers. Many storm damage cleanup contractors have the ability to provide detailed, itemized invoices to differentiate between the cost of tree removal, debris hauling, and any other services related to the cleanup.

Verify Contractor Certifications and Insurance

Regardless of the contractor you hire, ensure the contractor carries adequate insurance for tree removal operations, including General Liability and Workers’ Compensation. Request proof of insurance prior to allowing any contractor to begin performing work on your property. Adequate insurance protection for contractors can protect you from liability for accidents occurring during cleanup operations.

Common Disputes During Claims

Claims disputes often revolve around whether the tree failure was caused by a storm or if some existing condition contributed to the tree failure. Insurers may assert that proper maintenance would have avoided damage to the tree, particularly if the tree appears to be older and has visible decline. Providing documentation of the severity of the storm and the sudden nature of the tree failure can help counter these assertions.

Other disputes often revolve around the estimated cost of repairs and/or replacement of damaged property. Get bids from two or more licensed contractors to support any settlement offers provided by the insurance company. If the insurance company offers a settlement that is lower than a reasonable estimate of repair/replacement costs, get an explanation of their calculation method and present evidence to support a higher estimate.

Appeal Process

When insurance companies refuse to pay a claim, or when the payment offered is less than the actual cost of repair/replacement, you can file an appeal of their decision. Write to the insurance company and ask for a denial letter stating the reasons why your claim is being denied based on the specific provisions of your policy. If necessary, consult with a Public Adjuster or Attorney specializing in insurance claims to assist with your dispute.

Trees From Neighboring Properties That Fall on Your Property

A fallen tree from a neighboring property that falls on your property is usually considered a covered loss under your homeowner’s policy. Your insurance company will handle the claim, and if there are any excess funds paid, they may attempt to recover those excess funds from your neighbor’s insurance company via subrogation. This is usually handled by the insurance company in the background and does not require your direct participation.

However, if a neighbor had visible disease or structural weakness in the trees before the storm, there may be potential for a negligence lawsuit. Document the hazard trees on your neighbor’s property with photos and written communication. If necessary, write a formal letter to your neighbor notifying them of the hazardous trees that are now a threat to your property.

Proactive Maintenance to Prevent Damage Caused by Storms

Proactive maintenance of trees can help identify potential problems with trees prior to a storm. Certified arborists can identify structural weaknesses, disease conditions, and other factors that contribute to the likelihood of a tree failing in a storm. Removing or treating potentially hazardous trees proactively can reduce the risk of damage to your property and demonstrate good faith and responsibility to your insurance company.

Pruning your trees to reduce the risk of wind damage and to remove hazardous branches overhanging structures can also help. Regularly inspecting your trees for signs of decline (dead branches, fungus, etc.) can also help identify hazards. Trees that are near buildings, driveways, or utility lines are at a higher risk and therefore require closer scrutiny.

Restoration After a Storm

Full restoration of your property after a storm goes far beyond simply removing the trees and repairing the damaged structures. Landscaping restoration, soil stabilization, and planting new vegetation restore both the aesthetic beauty and functionality of your property. Some homeowner’s insurance policies may include limited coverage for restoring your landscaping, usually capped at 5% of your Dwelling coverage.

By selecting storm-resistant tree species and designing your landscape with reduced risks in mind, you can create a beautiful landscape while minimizing the risks of damage to your property from future storms. Consult with a certified arborist to select the most suitable species for your property and your goals.

When to Call a Professional

Certain storm situations clearly require immediate professional assistance. For example, trees that are leaning against a structure and appear to be unstable, branches that appear to be ready to fall, or any situation that involves utility lines. Likewise, removing large trees that require special equipment for safe removal exceeds the capability of most homeowners.

While it seems simple enough to clear up after a storm, many situations involve hidden dangers and complexities that are best addressed by a professional. Compressed or stretched wood can cause serious “spring-back” potential, and the root system of a tree can remain connected to your property after a tree has been removed, leaving the soil unstable. Professional assessment ensures safe, efficient storm damage cleanup and protects your property and insurance interests.

Storm Recovery Expertise

Union City residents dealing with storm damage need prompt, reliable, and experts in storm damage cleanup who are aware of the technical aspects of tree removal and insurance policies. Prompt action can prevent additional damage, while proper documentation provides a basis for a complete recovery of your insurance claim. At Union City Tree Experts, we provide 24/7 storm damage cleanup services for emergencies. We handle everything from initial stabilization of your property through to final cleanup, and we work closely with your insurance adjusters to facilitate your recovery, while ensuring you receive the maximum benefits available under your policy.